Gaming Laptop vs Desktop Preferences (2025)

In 2025, the debate between gaming laptops and desktops continues to evolve beyond simple portability versus performance considerations. Market data reveals distinct patterns in consumer preferences, with gaming hardware upgrade frequency playing a crucial role in purchasing decisions. This comprehensive analysis examines verified industry statistics, market share distributions, and consumer behavior patterns that define the gaming PC landscape.

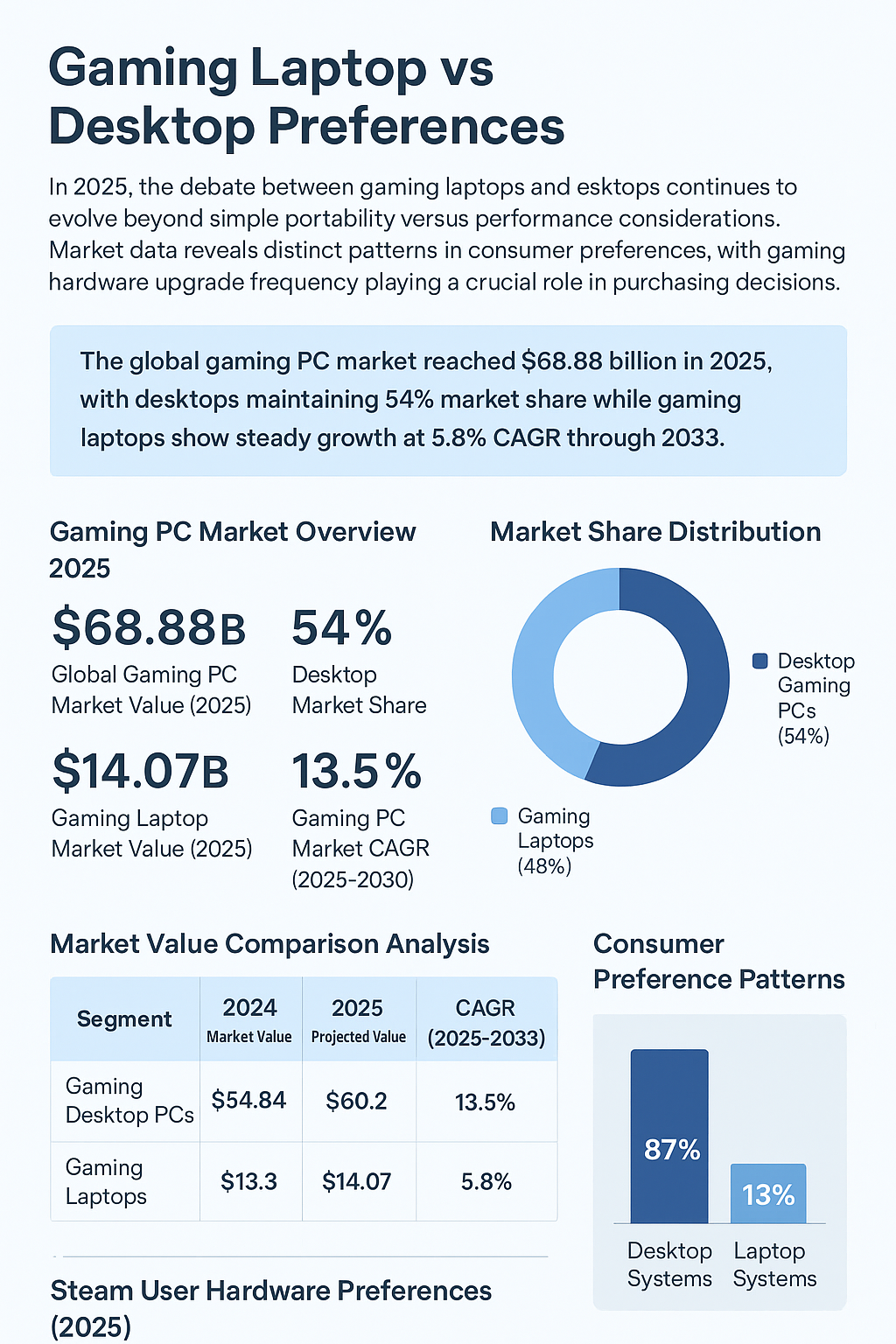

The global gaming PC market reached $68.88 billion in 2025, with desktops maintaining 54% market share while gaming laptops show steady growth at 5.8% CAGR through 2033.

Gaming PC Market Overview 2025

Market Share Distribution

Desktop gaming systems continue to dominate the market due to superior performance capabilities, cost-effectiveness, and upgrade flexibility. The multiplayer vs single-player gaming preferences data shows that competitive gamers, who comprise a significant portion of desktop users, prioritize maximum performance for titles requiring high frame rates and minimal latency.

Market Value Comparison Analysis

| Segment | 2024 Market Value | 2025 Projected Value | CAGR (2025-2033) | Market Share |

|---|---|---|---|---|

| Gaming Desktop PCs | $54.84 billion | $60.2 billion | 13.5% | 54% |

| Gaming Laptops | $13.3 billion | $14.07 billion | 5.8% | 46% |

Regional Market Performance

Asia-Pacific leads global gaming PC adoption with 52% market share, driven by strong esports infrastructure and government support in countries like China, Japan, and South Korea. The region’s preference for global esports revenue projections correlates with higher investment in performance-oriented gaming hardware.

Consumer Preference Patterns

Performance vs Portability Considerations

Steam Hardware Survey data from 2025 reveals that desktop GPUs account for approximately 87% of enthusiast gamer systems, while notebook GPUs represent 13%. This distribution reflects the persistent performance gap between mobile and desktop components, particularly in demanding applications requiring sustained high-performance computing.

Price Segment Analysis

Mid-range gaming systems priced between $1,000-$2,500 dominate the market with 43.4% share, offering optimal price-to-performance ratios. This segment appeals to both enthusiast gamers and mainstream users seeking quality gaming experiences without premium pricing. The minecraft economic marketplace analytics demonstrates how gaming hardware investments correlate with engagement in gaming ecosystems.

| Price Range | Market Share | Primary Target | Growth Rate |

|---|---|---|---|

| Entry-level (<$1,000) | 31.2% | Casual gamers | 18.2% |

| Mid-range ($1,000-$2,500) | 43.4% | Enthusiast gamers | 12.1% |

| High-end ($2,500+) | 25.4% | Professional gamers | 15.7% |

Market Growth Projections

Long-term Growth Outlook

The gaming PC market demonstrates robust growth prospects, with overall projections indicating a 13.5% CAGR through 2030. Desktop segments show stronger growth potential at 13.5% CAGR compared to laptops at 5.8% CAGR, reflecting continued demand for high-performance gaming solutions among dedicated enthusiasts.

Technology Adoption Trends

Artificial intelligence integration in gaming hardware represents a significant growth driver, with AI-capable PCs gaining adoption across both desktop and laptop segments. The convergence of gaming and content creation demands has influenced hardware specifications, with minecraft content creation streaming analytics showing increased requirements for systems capable of simultaneous gaming and streaming.

Distribution Channel Analysis

Online vs Offline Sales Performance

Physical retail channels maintain 54% market share in gaming PC sales, driven by consumer preference for hands-on evaluation of high-value purchases. However, online channels are projected to grow at 15% CAGR through 2032, supported by competitive pricing, comprehensive product selections, and convenient delivery options.

The growth of specialized gaming communities has influenced purchasing patterns, with Twitch statistics indicating correlation between streaming platform engagement and gaming hardware investment decisions.

Component Market Dynamics

Processor Market Competition

AMD has achieved significant market share gains, reaching 40% of Steam users in 2025, up from 31.9% in August 2024. This represents a 9% increase in Intel’s market dominance, driven by AMD’s competitive Ryzen processor lineup and enhanced gaming performance characteristics.

Graphics Card Preferences

NVIDIA maintains market leadership with the RTX 4060 representing the most popular desktop GPU at 4.57% adoption, while the RTX 4060 Laptop leads mobile graphics at 4.80%. Mid-range GPUs dominate adoption patterns, reflecting consumer preference for balanced price-performance solutions.

Future Market Considerations

Emerging Technology Integration

Virtual reality and augmented reality gaming requirements are driving demand for high-performance systems capable of supporting immersive experiences. The integration of ray tracing technology and 4K gaming capabilities continues to favor desktop configurations due to thermal and power constraints in mobile form factors.

Cloud gaming services represent both opportunity and challenge for traditional gaming PC manufacturers, potentially reducing demand for high-end local hardware while creating new market segments for streaming-optimized devices.

Supply Chain and Manufacturing Trends

Global supply chain diversification continues as manufacturers adapt to trade policy changes and tariff implications. Major OEMs are expanding production capacity outside China to Vietnam, Thailand, and India, with 90% of US-bound shipments expected to originate from non-Chinese facilities by end-2025.

The growing importance of minecraft server multiplayer analytics demonstrates how gaming infrastructure requirements influence hardware specifications and market demand patterns.

Frequently Asked Questions

Which is better for gaming: laptop or desktop in 2025?

Desktop PCs maintain performance advantages in 2025, offering superior cooling, upgradeability, and price-to-performance ratios. However, gaming laptops have significantly improved, with modern systems providing desktop-class performance in portable form factors. The choice depends on mobility requirements, budget constraints, and performance expectations. For maximum performance and value, desktops remain optimal, while laptops excel for users requiring portability.

What percentage of gamers prefer desktop vs laptop PCs?

According to 2025 Steam Hardware Survey data, approximately 87% of enthusiast gamers use desktop systems, while 13% use laptops. However, this varies by gaming segment and region. Professional and competitive gamers show stronger desktop preference due to performance requirements, while casual gamers increasingly adopt laptops for convenience.

How fast is the gaming laptop market growing compared to desktops?

Gaming laptops are growing at 5.8% CAGR through 2033, while desktop gaming PCs show 13.5% CAGR. Despite slower growth, laptops represent significant opportunity in emerging markets and among mobile-first demographics. The laptop segment benefits from technological advances in mobile processors, graphics cards, and thermal management systems.

What factors drive gaming PC purchasing decisions in 2025?

Primary factors include performance requirements, budget constraints, upgrade flexibility, and portability needs. Mid-range systems ($1,000-$2,500) dominate with 43.4% market share due to optimal price-performance balance. AI capabilities, ray tracing support, and VR compatibility increasingly influence purchase decisions as these technologies become mainstream.

Which regions show strongest gaming PC market growth?

Asia-Pacific leads with 52% global market share, driven by strong esports infrastructure and government support. North America accounts for 29.4% share, while Europe represents 18.6%. Emerging markets like India show particular strength in laptop adoption due to infrastructure considerations and mobility preferences.

How do online vs offline sales compare for gaming PCs?

Offline retail maintains 54% market share due to consumer preference for evaluating high-value purchases hands-on. Online channels grow at 15% CAGR, driven by competitive pricing, broader selection, and convenience. The channel mix varies by region and product category, with laptops showing higher online adoption rates.

Sources and References

- Grand View Research. (2025). “Gaming PC Market Size And Trends | Industry Report, 2030.” https://www.grandviewresearch.com/industry-analysis/gaming-pc-market-report

- Market Data Forecast. (2025). “Gaming PC Market Size, Share, Trends & Growth Report, 2033.” https://www.marketdataforecast.com/market-reports/gaming-pc-market

- Business Research Insights. (2025). “Gaming Laptop Market Size, Share | Research Report to 2033.” https://www.businessresearchinsights.com/market-reports/gaming-laptop-market-117823

- Canalys. (2025). “Worldwide PC shipments up 9% in Q1 2025 but tariffs threaten future market performance.” https://www.canalys.com/newsroom/worldwide-pc-shipments-q1-2025

- Tom’s Hardware. (2025). “AMD CPUs surpass the 40% threshold in latest Steam hardware survey.” https://www.tomshardware.com/pc-components/cpus/amd-cpus-surpass-the-40-percent-threshold-in-latest-steam-hardware-survey-rtx-5070-emerges-as-the-most-preferred-gpu-within-the-blackwell-series