Epic Games Store vs Steam Market Share Statistics (2025)

The competition between Steam and Epic Games Store continues to reshape the digital PC gaming landscape in 2025. While Steam maintains its position as the dominant platform, Epic Games Store has emerged as a significant challenger through aggressive developer incentives and exclusive content strategies. This comprehensive analysis examines the latest market share statistics, user engagement metrics, and revenue performance of both platforms.

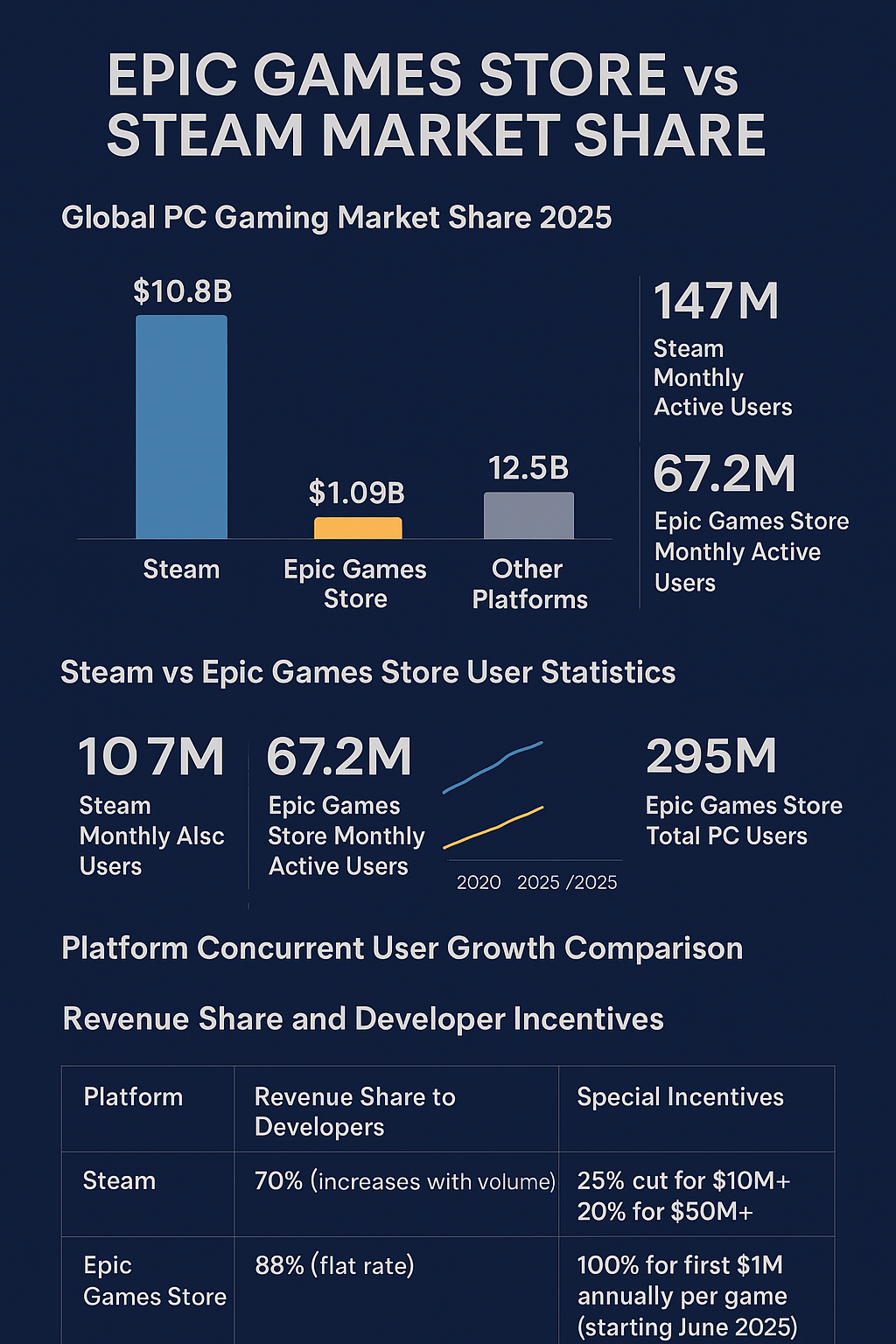

Global PC Gaming Market Share 2025

PC Gaming Platform Revenue Distribution

Steam continues to dominate the PC gaming market with approximately 75% market share in 2025, generating $10.8 billion in revenue during 2024, representing a remarkable 24.14% increase from the previous year. Epic Games Store, while significantly smaller, achieved $1.09 billion in revenue with steady growth in user acquisition and in-game purchase spending habits among its player base.

Steam vs Epic Games Store User Statistics

Steam achieved a historic milestone in March 2025 by reaching 40.27 million concurrent users, demonstrating the platform’s continued growth and engagement. The platform maintains 147 million monthly active users, showing consistent engagement across its global audience. Epic Games Store reached 295 million total PC users by the end of 2024, with 67.2 million monthly active users, representing a 6% year-over-year growth rate.

Platform Concurrent User Growth Comparison

Revenue Share and Developer Incentives

| Platform | Revenue Share to Developers | Special Incentives |

|---|---|---|

| Steam | 70% (increases with volume) | 25% cut for $10M+, 20% for $50M+ |

| Epic Games Store | 88% (flat rate) | 100% for first $1M annually per game (starting June 2025) |

Epic Games Store continues to offer the most developer-friendly revenue split in the industry, with developers keeping 88% of revenue compared to Steam’s standard 70%. Starting in June 2025, Epic will waive all fees on the first $1 million in annual revenue per game, making it extremely attractive for smaller studios and indie developers. This aggressive strategy reflects Epic’s commitment to challenging Steam’s market dominance through hardware upgrade preferences and platform accessibility.

Game Library and Content Analysis

Platform Game Library Comparison 2025

Steam’s vast game library remains unmatched with over 101,000 titles available, adding 15,422 new games in 2024 alone. Epic Games Store maintains a curated approach with 2,650 games, focusing on quality over quantity. This strategy aligns with the broader trends in multiplayer versus single-player gaming preferences that influence platform selection decisions.

Third-Party Revenue Performance

Epic Games Store’s third-party revenue declined 18% to $255 million in 2024, down from $310 million in 2023. This decrease reflects increased competition and user preference for Epic’s first-party titles like Fortnite and Rocket League. The platform’s total revenue of $1.09 billion includes significant contributions from these proprietary games, highlighting the challenge of competing with Steam’s established ecosystem.

Steam’s estimated third-party revenue ranges between $8-10 billion annually, demonstrating the significant gap in market penetration. This disparity illustrates the importance of established developer relationships and comprehensive platform features in maintaining market leadership. The competition has parallels to developments in global esports revenue projections where platform exclusivity plays a crucial role.

Mobile Platform Expansion

Epic Games Store launched on Android devices worldwide and iOS devices for European users in August 2024, following regulatory changes under the Digital Markets Act. This expansion represents a significant opportunity for Epic to challenge Apple and Google’s mobile platform dominance. The mobile gaming market’s growth connects to broader trends in gaming hardware preferences as players seek cross-platform experiences.

Market Forecast and Future Projections

2026 Market Share Projections

Market analysts forecast Steam will retain approximately 72% market share by 2026, with Epic Games Store expected to grow modestly to 8.2%. The projected growth reflects Epic’s continued investment in exclusive content and developer incentives, though Steam’s entrenched ecosystem poses significant competitive barriers. These projections align with broader industry trends observed in streaming platform analytics where established platforms maintain advantages despite aggressive competition.

Platform Infrastructure and Global Reach

Steam operates 34 server regions with advanced latency optimization through Akamai’s content delivery network, providing superior download speeds globally. Epic Games Store maintains 10 server regions using Amazon Web Services, focusing on major markets while expanding infrastructure investment. The disparity in global infrastructure affects user experience and contributes to platform preference decisions, particularly in emerging markets where connection quality significantly impacts gaming performance.

Frequently Asked Questions

What is Steam’s current market share compared to Epic Games Store?

How many monthly active users does each platform have?

Which platform offers better revenue sharing for developers?

What are the major differences in game library size?

How do concurrent user records compare between platforms?

What is the outlook for Epic Games Store’s market share growth?

Sources and Citations

- DemandSage – Steam Statistics 2025: Users & Revenue Data

- VentureBeat – Epic Games Store hits nearly 300 million PC users in 2024

- TechPowerUp – Steam Breaks its Own Record: 40 Million Concurrent Users Online

- GamesMarkt – Epic Games Store Tops $1 Billion in 2024

- Player Counter – Epic Games Store vs Steam Market Share Statistics