Gaming Subscription Service Adoption Rates (2025)

Gaming subscription service adoption rates have transformed the entertainment industry, reaching unprecedented levels in 2025. The subscription gaming market has evolved from traditional purchase models to comprehensive service platforms that offer continuous value to millions of players worldwide.

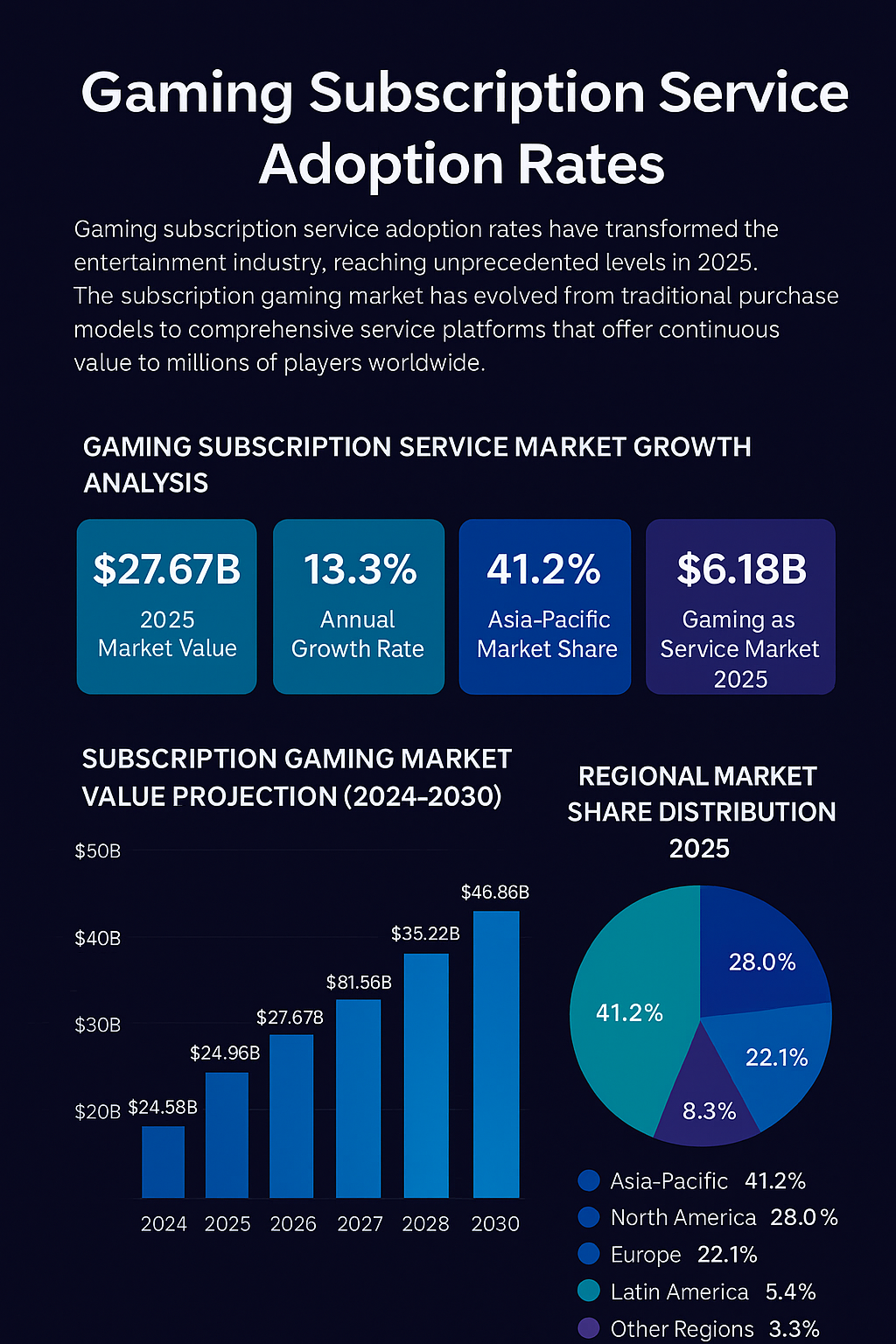

Gaming Subscription Service Market Growth Analysis

The global subscription-based gaming market demonstrates remarkable expansion, with gaming subscription service adoption rates climbing significantly across all major platforms. Service providers like Xbox Game Pass and PlayStation Plus leading console adoption, while mobile gaming subscriptions surge through smartphone platforms.

Subscription Gaming Market Value Projection (2024-2030)

Regional Gaming Subscription Adoption Trends

Gaming subscription service adoption rates vary significantly across global regions, with Asia-Pacific emerging as the dominant market. The region’s leadership stems from massive smartphone penetration, affordable mobile data plans, and strong local gaming ecosystems in countries like China, India, Japan, and South Korea.

Regional Market Share Distribution 2025

North America maintains strong subscription gaming adoption, particularly in the United States where premium services capture dedicated gaming audiences. The region benefits from advanced digital infrastructure and consumer willingness to invest in high-quality gaming experiences. European markets show steady growth, with countries like Germany, United Kingdom, and France leading regional adoption rates.

Asia-Pacific Market Dominance

Asia-Pacific’s commanding 41.2% market share reflects the region’s mobile-first gaming culture and massive user base. Countries like China generated $1.88 billion in gaming subscription revenue during 2024, supported by robust broadband infrastructure and localized gaming content. India’s market expansion demonstrates similar trajectory with rapid 5G deployment and increasing smartphone adoption rates.

The region’s gaming subscription service adoption rates benefit from cultural preferences for multiplayer gaming and social features. Local gaming giants have established comprehensive platforms that integrate in-game purchase systems with subscription models, creating sustainable revenue streams.

North American Gaming Subscription Landscape

North American gaming subscription service adoption rates reflect mature market dynamics, with established platforms like Xbox Game Pass reaching 34 million subscribers by early 2024. The region’s $50.6 billion gaming market supports premium subscription tiers that offer exclusive content, early access releases, and cloud gaming capabilities.

United States subscribers particularly value comprehensive game libraries and cross-platform compatibility. The integration of cloud gaming services allows users to access high-end titles without expensive hardware investments, driving subscription growth among casual and hardcore gamers alike.

Gaming Platform Subscription Adoption Patterns

Platform-specific gaming subscription service adoption rates reveal distinct user preferences and technological trends. Personal computer platforms maintain leadership with 57-58% revenue share, while mobile gaming subscriptions demonstrate the fastest growth trajectory through 2030.

Platform Revenue Distribution in Gaming Subscriptions

PC Gaming Subscription Services

Personal computer gaming subscription service adoption rates maintain strength due to platform advantages in processing power, customization options, and peripheral compatibility. PC gamers frequently engage with multiple subscription services simultaneously, accessing diverse game libraries through platforms like Steam and Epic Games Store.

The PC gaming market benefits from integrated cloud gaming and subscription services, offering users extensive game libraries without frequent hardware upgrades. Enthusiast gamers particularly value PC platforms for esports, modding communities, and competitive online gaming experiences.

Mobile Gaming Subscription Growth

Mobile gaming subscription service adoption rates experience rapid expansion, driven by smartphone improvements and 5G network deployment. Mobile platforms attract users through convenient access, social gaming features, and affordable subscription pricing models.

The segment benefits from increasing smartphone penetration in emerging markets, particularly across Asia-Pacific regions. Mobile gaming subscriptions integrate seamlessly with multiplayer gaming preferences and social connectivity features that enhance user engagement.

Gaming as a Service Market Evolution

Gaming as a Service represents the most dynamic segment within subscription gaming, with market value growing from $4.91 billion in 2024 to projected $6.18 billion in 2025. This 24.9% compound annual growth rate demonstrates the sector’s transformation toward cloud-based gaming delivery systems.

Gaming as a Service Market Expansion (2024-2030)

Cloud gaming platforms reshape access patterns by eliminating hardware constraints, enabling high-quality gaming experiences across various devices through subscription models. The Gaming as a Service adoption extends beyond traditional gaming, influencing educational platforms and entertainment streaming services that integrate gaming elements.

Cloud Gaming Infrastructure Development

Gaming subscription service adoption rates accelerate through improved cloud infrastructure and 5G network expansion. Asia-Pacific alone expects approximately 1.5 billion 5G mobile subscriptions by 2025, providing robust technical foundation for cloud gaming services.

Major technology companies invest heavily in cloud gaming capabilities, with Microsoft’s Azure, Google’s Stadia technology, and NVIDIA’s GeForce Now platforms competing for market leadership. These investments drive innovation in streaming technology, reducing latency and improving visual quality for subscribers.

Subscription Model Innovation

Gaming subscription service adoption benefits from tiered pricing strategies that cater to diverse user preferences and budgets. Premium tiers offer exclusive content, early access releases, and enhanced features, while basic subscriptions provide affordable entry points for casual gamers.

The evolution toward hybrid monetization models combines subscription revenue with in-game purchases and advertising revenue, creating sustainable business models that support continuous content development and platform improvements.

Genre-Specific Subscription Adoption Analysis

Gaming subscription service adoption rates vary significantly across different game genres, with action games capturing 24.1% of subscription revenue share in 2024. Genre preferences influence platform choices and subscription duration patterns among different user demographics.

Role-playing games demonstrate strong subscription engagement due to their emphasis on character progression, narrative depth, and long-term player investment. These titles benefit from continuous content updates and expansion packs that justify ongoing subscription costs.

Action Game Subscription Dominance

Action games maintain leadership in gaming subscription service adoption rates through immersive gameplay experiences and competitive multiplayer features. The genre’s popularity stems from quick learning curves, social gaming elements, and regular content updates that maintain player engagement.

Battle royale and multiplayer online battle arena games particularly drive subscription growth through seasonal content updates, cosmetic item systems, and competitive ranking systems. These features encourage sustained subscription commitments from dedicated player communities.

Emerging Genre Trends

Role-playing games exhibit the highest projected growth rates through 2030, driven by increasing demand for immersive, narrative-driven experiences and character customization options. The genre benefits from player behavior analytics that inform content development and personalization features.

Simulation and strategy games gain traction among subscription services through educational value and long-term engagement patterns. These genres appeal to users seeking intellectual challenges and creative expression opportunities within gaming environments.

Market Challenges and Growth Opportunities

Gaming subscription service adoption faces several market challenges, including subscription fatigue among consumers managing multiple service commitments and increasing competition among platform providers. Market saturation in developed regions requires innovative approaches to maintain growth momentum.

Platform providers address these challenges through exclusive content partnerships, cross-platform compatibility improvements, and enhanced social features that increase user retention rates. The integration of artificial intelligence and machine learning technologies enables personalized gaming recommendations and optimized user experiences.

Technological Innovation Drivers

Gaming subscription service adoption benefits from advancing technologies including 5G networks, edge computing infrastructure, and improved compression algorithms that enhance streaming quality. These technological improvements reduce barriers to cloud gaming adoption and expand accessible device categories.

Virtual reality and augmented reality integration presents significant growth opportunities for subscription services, offering immersive gaming experiences that justify premium pricing tiers. Early adoption of these technologies provides competitive advantages for platform providers.

Market Expansion Strategies

Emerging markets represent substantial growth opportunities for gaming subscription service adoption, particularly in regions with rapidly improving internet infrastructure and increasing smartphone penetration. Localized content development and region-specific pricing strategies facilitate market entry and user acquisition.

Strategic partnerships with telecommunications providers, device manufacturers, and content creators expand distribution channels and reduce customer acquisition costs. These collaborations often bundle gaming subscriptions with internet services or device purchases, increasing adoption rates.

Future Projections and Industry Outlook

Gaming subscription service adoption rates project continued strong growth through 2030, with the broader gaming subscription market expected to reach $46.86 billion by 2035, representing a 13.4% compound annual growth rate. This expansion reflects fundamental shifts in consumer preferences toward service-based entertainment consumption.

The industry evolution toward subscription models influences game development practices, encouraging developers to create content designed for long-term engagement rather than single-purchase experiences. This shift promotes ongoing player communities and sustainable revenue generation for content creators.

Long-term Market Projection (2025-2035)

Industry consolidation continues as major technology companies acquire gaming studios and platforms to strengthen their subscription service offerings. These acquisitions provide exclusive content libraries and development capabilities that differentiate subscription platforms in competitive markets.

Technology Integration Trends

Gaming subscription service adoption increasingly integrates with broader entertainment ecosystems, including streaming video platforms, social media networks, and digital commerce systems. This convergence creates comprehensive entertainment packages that increase user engagement and reduce subscription churn rates.

Cross-platform compatibility becomes essential for subscription success, allowing users to access gaming content across multiple device types and gaming hardware configurations. Platform providers invest significantly in technical infrastructure supporting seamless user experiences across different devices.

Subscription Service Evolution

Future gaming subscription services likely incorporate advanced personalization features, social gaming elements, and educational content that appeals to broader demographic segments. The integration of streaming and content creation tools creates additional value propositions for subscription users.

Sustainability considerations influence subscription service development, with providers focusing on energy-efficient cloud infrastructure and environmentally responsible business practices that appeal to environmentally conscious consumers.

Frequently Asked Questions

Gaming subscription service adoption rates reached significant milestones in 2025, with the global subscription-based gaming market valued at $27.67 billion. The market demonstrates a 13.3% compound annual growth rate, with Asia-Pacific leading adoption at 41.2% market share. Approximately 20% of gamers in the United States actively pay for subscription services, while emerging markets like India and Indonesia show higher adoption rates exceeding 40%.

PC and laptop platforms dominate gaming subscription service adoption with 58.4% revenue share, followed by mobile platforms at approximately 25% and console platforms at 17%. However, mobile gaming subscriptions demonstrate the fastest growth trajectory through 2030, driven by smartphone improvements, 5G deployment, and affordable subscription pricing models across emerging markets.

Regional gaming subscription service adoption rates vary significantly, with Asia-Pacific commanding 41.2% global market share, followed by North America at 28% and Europe at 22.1%. Asia-Pacific’s leadership stems from massive smartphone penetration, affordable data plans, and strong local gaming ecosystems in countries like China, India, Japan, and South Korea. China alone generated $1.88 billion in gaming subscription revenue during 2024.

Gaming as a Service adoption grows at 24.9% annually, reaching $6.18 billion in 2025 from $4.91 billion in 2024. Key drivers include cloud gaming infrastructure improvements, 5G network expansion, elimination of hardware constraints, and consumer preference for flexible access to diverse game libraries. The model allows high-quality gaming experiences across various devices without expensive hardware investments.

Action games lead gaming subscription service adoption with 24.1% revenue share, followed by role-playing games showing the highest growth rates through 2030. Action games benefit from immersive gameplay, competitive multiplayer features, and regular content updates. Role-playing games attract subscribers through narrative depth, character progression systems, and long-term player investment opportunities that justify ongoing subscription costs.

Gaming subscription service adoption rates project strong continued growth, with the market expected to reach $46.86 billion by 2035, representing a 13.4% compound annual growth rate. Gaming as a Service specifically may reach $18.82 billion by 2030. Future growth depends on 5G infrastructure expansion, cloud gaming technology improvements, cross-platform compatibility enhancements, and integration with broader entertainment ecosystems.

Citations and Sources

- Grand View Research. (2024). “Subscription-Based Gaming Market Size, Share Report, 2030.” https://www.grandviewresearch.com/industry-analysis/subscription-based-gaming-market-report

- Market Research Future. (2025). “Subscription-Based Gaming Market Size, Market Assessment & Forecast 2033.” https://www.marketresearchfuture.com/reports/subscription-based-gaming-market-24415

- Market.us. (2025). “Online Gaming Subscription Services Market Size | CAGR of 15%.” https://market.us/report/online-gaming-subscription-services-market/

- Grand View Research. (2024). “Gaming As A Service Market Size | Industry Report, 2030.” https://www.grandviewresearch.com/industry-analysis/gaming-as-a-service-market-report

- Mordor Intelligence. (2025). “Subscription-Based Gaming Market Size & Share Analysis – Industry Research Report – Growth Trends.” https://www.mordorintelligence.com/industry-reports/global-subscription-based-gaming-market