Global Esports Revenue Projections For 2025

The global esports industry has evolved from a niche community activity into a mainstream entertainment powerhouse. By 2025, the industry is projected to generate unprecedented revenues, driven by substantial investments from gaming companies, streaming platforms, and international brands seeking to connect with digitally native audiences.

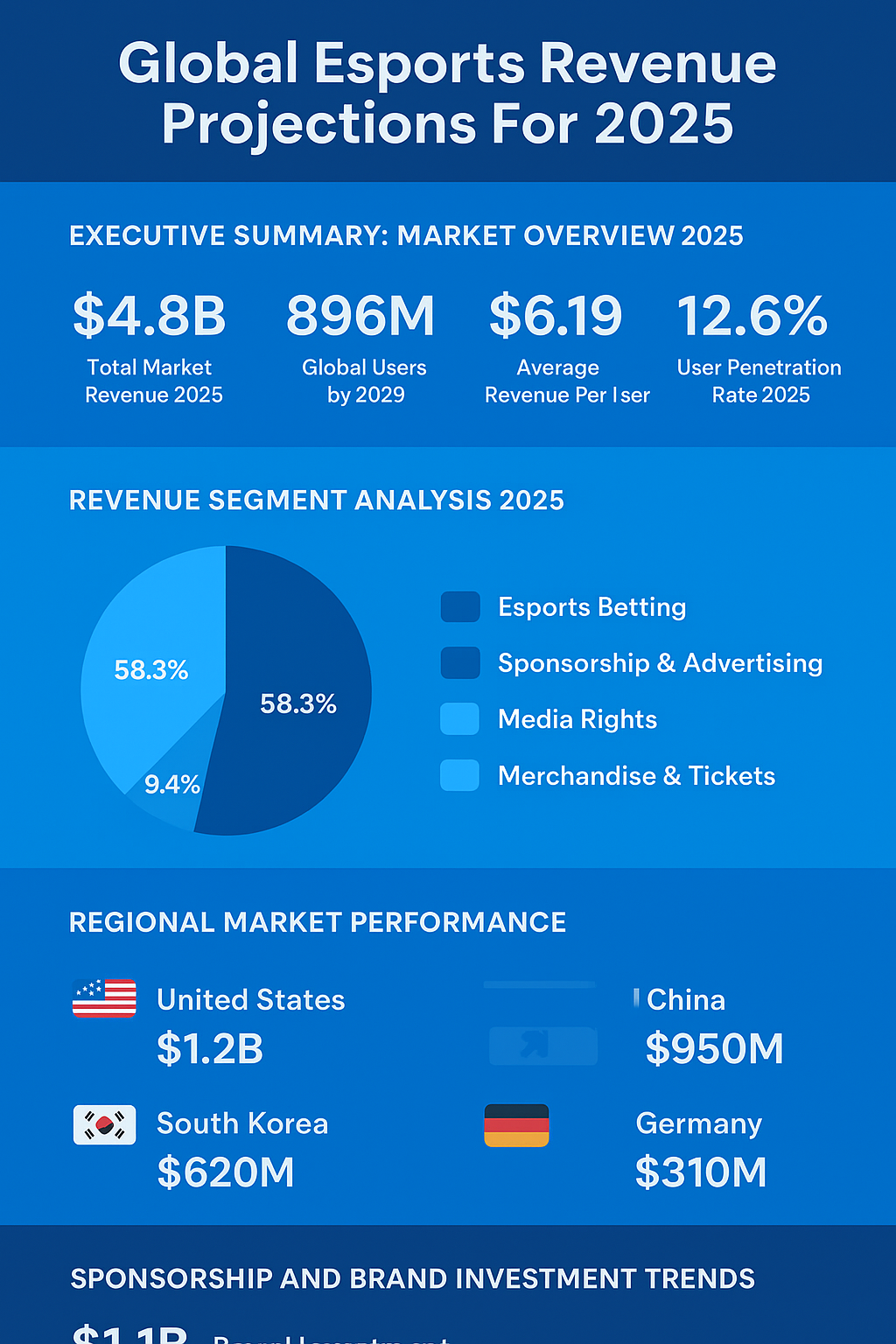

Executive Summary: Market Overview 2025

The competitive gaming landscape continues its remarkable expansion trajectory, with market analysts projecting significant revenue growth across multiple segments. Current projections indicate the global esports market will reach $4.8 billion in total revenue by 2025, encompassing various revenue streams including sponsorships, media rights, betting, and merchandise sales.

Revenue Segment Analysis 2025

The esports revenue ecosystem demonstrates remarkable diversity, with multiple monetization channels contributing to the industry’s financial success. Betting operations represent the largest segment, while sponsorship and advertising continue growing as brands recognize the value of reaching engaged gaming audiences.

Esports Revenue by Segment (2025 Projections)

| Revenue Segment | Projected Revenue (2025) | Market Share | CAGR (2025-2029) |

|---|---|---|---|

| Esports Betting | $2.8 billion | 58.3% | 6.1% |

| Sponsorship & Advertising | $1.1 billion | 22.9% | 4.8% |

| Media Rights | $450 million | 9.4% | 5.2% |

| Merchandise & Tickets | $300 million | 6.3% | 3.9% |

| Publisher Fees & Other | $150 million | 3.1% | 4.5% |

Key Market Insights

- Betting operations dominate revenue generation, representing nearly 60% of total market value

- Sponsorship revenue demonstrates steady growth as brands increasingly target gaming demographics

- Media rights revenue reflects growing broadcaster interest in competitive gaming content

- Mobile esports viewership increased 41% from 2023 to 2024, driving engagement across platforms

Regional Market Performance

Geographic distribution of esports revenue reveals clear market leaders, with North America and Asia Pacific regions driving the majority of industry growth. The United States maintains its position as the dominant market, while emerging regions show promising expansion potential.

Esports Revenue by Country (2025)

| Country/Region | Projected Revenue (2025) | Market Share | Key Growth Drivers |

|---|---|---|---|

| United States | $1.2 billion | 25.0% | High internet penetration, strong sponsor ecosystem |

| China | $950 million | 19.8% | Massive mobile gaming audience, government support |

| South Korea | $620 million | 12.9% | Established esports infrastructure, cultural acceptance |

| Germany | $310 million | 6.5% | European market leadership, strong sponsor base |

| India | $280 million | 5.8% | Rapid mobile adoption, young demographic |

Sponsorship and Brand Investment Trends

Corporate sponsorship represents a crucial revenue pillar for the esports ecosystem, with major brands allocating significant budgets to reach engaged gaming audiences. The gaming economic marketplace continues attracting non-endemic sponsors seeking authentic connections with digital natives.

Major Brand Sponsorship Investments (2025)

Leading brands are moving beyond traditional logo placements toward immersive, experience-driven activations. Companies like Red Bull, Intel, and Nike are investing heavily in team partnerships, tournament hosting, and content creation initiatives. This evolution reflects the growing sophistication of player behavior and demographics within competitive gaming communities.

Sponsorship Evolution

- Brand investment expected to exceed $1.1 billion in 2025, representing 23% of total market revenue

- Non-endemic brands increasingly participate, bringing lifestyle and consumer goods marketing

- Virtual advertising and AR integrations provide new sponsor visibility opportunities

- Mobile esports sponsorships grow rapidly, reflecting platform accessibility and audience engagement

Streaming Platform Revenue Distribution

Digital streaming platforms serve as the primary distribution channel for competitive gaming content, generating substantial revenue through advertising, subscriptions, and exclusive broadcasting agreements. The multiplayer gaming analytics demonstrate the critical role of live streaming in audience engagement.

Streaming Revenue by Platform (2025)

Twitch maintains market leadership with $480 million in projected revenue, primarily from its North American user base and established creator ecosystem. YouTube Gaming leverages its global reach to generate $320 million, while regional platforms like DouYu capitalize on local audience preferences. These platforms benefit from increased viewership of crafting and creative content that resonates with diverse gaming communities.

Mobile Esports Growth Trajectory

Mobile competitive gaming represents the fastest-growing segment within the esports ecosystem, driven by smartphone accessibility, 5G infrastructure development, and culturally relevant game design. Mobile esports viewership increased 41% year-over-year, with titles like Mobile Legends: Bang Bang generating over 340 million hours watched annually.

Mobile Esports Growth Metrics

The accessibility of mobile competitive gaming has democratized esports participation, particularly in emerging markets where smartphone penetration exceeds traditional gaming hardware adoption. This trend aligns with broader patterns in digital currency usage and virtual economy engagement within gaming communities.

Audience Demographics and User Engagement

The global esports audience demonstrates impressive growth patterns, with user penetration expected to reach 12.6% in 2025 and continue expanding to 14.2% by 2029. The average revenue per user of $6.19 reflects the industry’s monetization efficiency, though significant growth potential remains as engagement deepens and new revenue streams emerge.

| Metric | 2025 Projection | 2029 Forecast | Growth Rate |

|---|---|---|---|

| Total Users | 780 million | 896 million | 3.5% CAGR |

| Esports Enthusiasts | 318 million | 365 million | 3.8% CAGR |

| Occasional Viewers | 322 million | 380 million | 4.2% CAGR |

| User Penetration | 12.6% | 14.2% | +1.6 percentage points |

Regional audience distribution shows Asia Pacific commanding over 57% of total viewership, with China and the Philippines contributing more than 40% of global esports fans. This geographic concentration influences content localization strategies and platform usage trends across different gaming communities.

Long-term Market Projections

Industry forecasts project continued growth through 2029, with the global esports market expected to reach $5.9 billion in total revenue. This represents a healthy compound annual growth rate of 5.54%, reflecting market maturation and sustainable expansion across key revenue segments.

Esports Market Growth Forecast (2025-2029)

Several factors support this optimistic outlook, including increased mainstream acceptance, Olympic recognition through sanctioned events, and continued investment in tournament infrastructure. The integration of emerging technologies like virtual reality and augmented reality promises to enhance viewing experiences and create new monetization opportunities. Additionally, the growth of live player engagement across various gaming platforms indicates sustained audience interest and participation.

Future Growth Drivers

- Olympic Esports Games 2027 will provide unprecedented mainstream visibility and legitimacy

- 5G network expansion enables enhanced mobile gaming experiences and broader accessibility

- Cross-platform integration allows seamless gaming experiences across devices and ecosystems

- AI-powered content personalization improves viewer engagement and retention rates

- Virtual and augmented reality technologies create immersive spectator experiences

Frequently Asked Questions

What factors drive esports revenue growth in 2025?

Primary growth drivers include increased sponsorship investment from non-endemic brands, expanding mobile esports accessibility, enhanced streaming technology, and growing mainstream acceptance. The integration of betting platforms and improved monetization strategies also contribute significantly to revenue expansion.

How does mobile esports impact overall market growth?

Mobile esports represents the fastest-growing segment, with 41% viewership increase year-over-year. The accessibility of mobile gaming democratizes competitive participation, particularly in emerging markets, driving audience expansion and creating new sponsorship opportunities.

Which regions show the strongest esports market potential?

The United States leads with $1.2 billion projected revenue, followed by China at $950 million. Emerging markets in Southeast Asia, India, and Latin America demonstrate significant growth potential due to increasing mobile adoption and improving digital infrastructure.

What role do streaming platforms play in esports monetization?

Streaming platforms generate over $1 billion collectively through advertising, subscriptions, and exclusive content deals. Twitch, YouTube Gaming, and regional platforms serve as primary distribution channels, enabling global audience reach and creator monetization.

How sustainable is the projected 5.54% CAGR through 2029?

The projected growth rate reflects market maturation and established revenue streams. Sustainability factors include Olympic recognition, mainstream media integration, technological advancement, and expanding global audience participation across diverse demographics.

Conclusion

The global esports industry demonstrates remarkable resilience and growth potential as it transitions from emerging market to established entertainment sector. With projected revenues of $4.8 billion in 2025 and continued expansion to $5.9 billion by 2029, competitive gaming has proven its commercial viability and cultural significance.

The diversification of revenue streams, from traditional sponsorships to innovative betting platforms and mobile-first experiences, creates a robust foundation for sustained growth. As brands increasingly recognize the value of authentic gaming community engagement and technological infrastructure continues improving, the esports ecosystem is positioned for continued success.

Key success factors moving forward include maintaining competitive integrity, fostering inclusive participation across demographics and regions, and adapting to evolving audience preferences. The integration of emerging technologies and expansion into mainstream entertainment channels will likely define the next phase of industry evolution.

Citations

- Statista Market Forecast. (2025). Esports market revenue worldwide projections 2025-2029

- Grand View Research. (2025). Global Esports Market Size & Growth Analysis Report 2025-2030

- Future Market Insights. (2025). eSports Market Trends & Innovations 2025–2035

- Esports Insider. (2025). Esports marketing statistics 2025: Top brands & trends

- Stream Hatchet. (2024). Esports Trends 2024: Mobile Games, Co-streaming, and Creators