In-Game Purchase Spending Habits (2025)

The landscape of gaming monetization has undergone a fundamental transformation, with in-game purchases now dominating revenue streams across all gaming platforms. As the industry approaches the $200 billion milestone in 2025, understanding consumer spending patterns, demographic shifts, and regional variations has become essential for industry stakeholders and gaming enthusiasts alike.

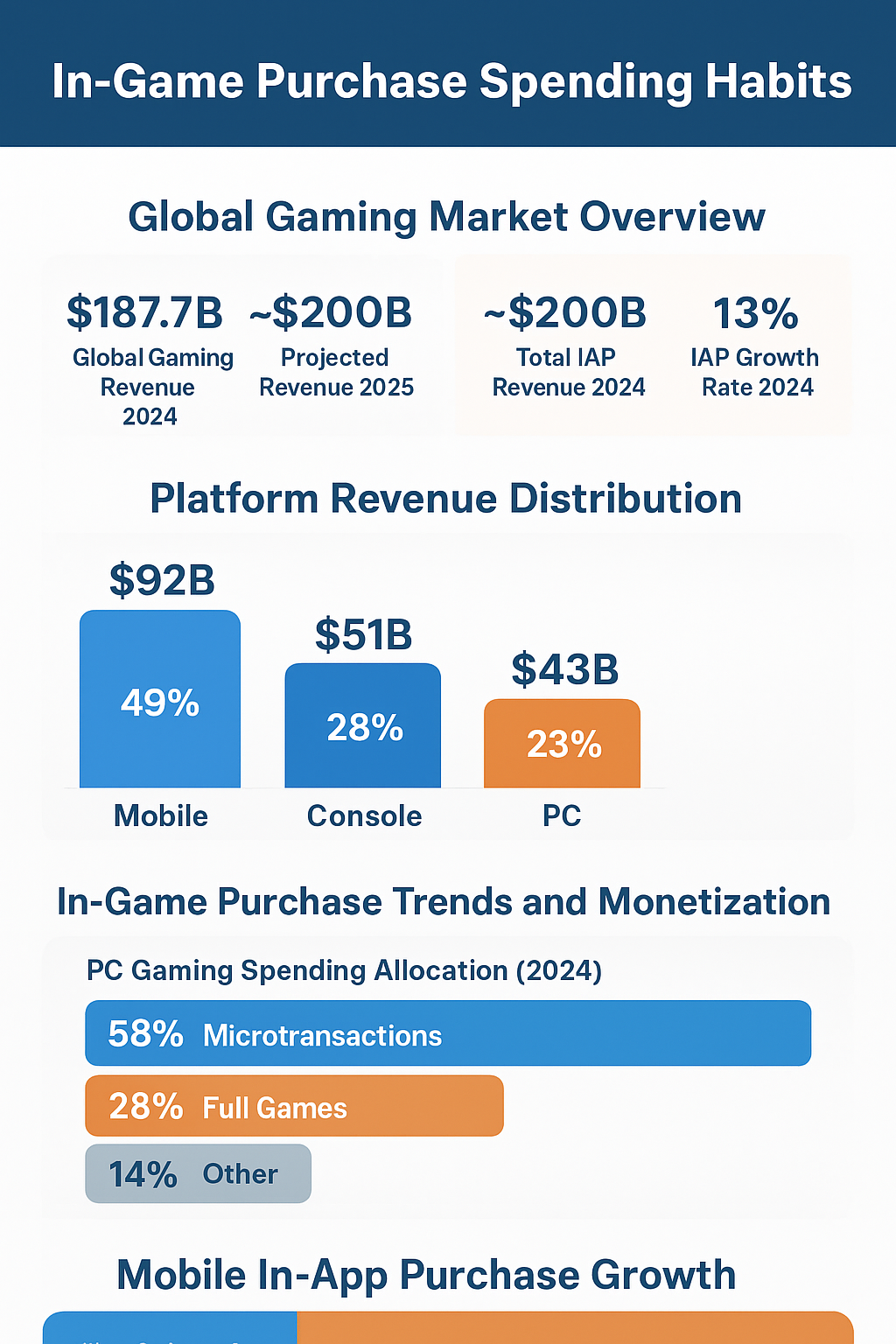

Global Gaming Market Overview

The gaming industry continues its upward trajectory, with global revenue reaching $187.7 billion in 2024 and projections indicating the market will approach the $200 billion milestone in 2025. This growth represents a significant achievement for an industry that has consistently outpaced traditional entertainment sectors like film and music.

Platform Revenue Distribution

Mobile gaming maintains its position as the dominant force in the industry, accounting for nearly half of all gaming revenue at $92 billion. This dominance reflects the widespread accessibility of smartphones and the effectiveness of mobile monetization strategies. Console gaming follows with $51 billion, while PC gaming contributes $43 billion to the total market.

In-Game Purchase Trends and Monetization

The shift toward in-game monetization has fundamentally altered how players engage with games and how developers generate revenue. On PC platforms alone, microtransactions now account for 58% of all gaming expenditure, while traditional full-game purchases have declined to just 28% of total spending.

Mobile In-App Purchase Growth

Mobile in-app purchases reached $81 billion in 2024, representing a 4% year-over-year increase. This growth comes after two consecutive years of decline, indicating the resilience and recovery of the mobile gaming market. The recovery was particularly strong in North America and Europe, though growth was tempered by slower performance in major Asian markets.

The regional variation in mobile IAP growth reveals interesting market dynamics. While Western and emerging markets showed robust growth, Asia experienced a 3% decline in USD terms, possibly due to currency fluctuations and market saturation effects in mature gaming economies like Japan and South Korea.

Demographic Shifts in Gaming Spending

Generation Z Spending Decline

One of the most significant trends in 2025 has been the sharp decline in gaming expenditure among Generation Z consumers. According to Circana research, spending by the 18-24 age demographic dropped by approximately 25% from January to April 2025 compared to the previous year, while older generations experienced minimal decreases of less than 5%.

This dramatic spending reduction among younger consumers reflects broader economic pressures affecting this demographic, including challenging job markets, student loan obligations, and rising living costs. Despite remaining active in gaming communities, representing 28% of all gamers as of March 2025, Generation Z has adapted by gravitating toward free-to-play titles, budget-friendly indie games, and waiting for promotional pricing on premium releases.

The rise of multiplayer gaming preferences has influenced this trend, with affordable cooperative games becoming increasingly popular among cost-conscious younger players seeking social gaming experiences without significant financial investment.

Regional Market Analysis

United States Gaming Market

The United States maintained its position as the leading gaming market with consumer spending totaling $59.3 billion in 2024. Of this amount, $51.3 billion was attributed to content purchases, including in-game transactions, digital and physical games, and subscription services. This content-focused spending pattern demonstrates the maturity of the American gaming market and the effectiveness of ongoing monetization strategies.

Japanese Market Dynamics

Japan presents a unique case study in gaming monetization challenges. A comprehensive survey conducted by SMBC Consumer Finance in February 2025, involving 1,000 participants aged 20-29, revealed concerning spending patterns among young Japanese adults.

The survey revealed that 18.8% of respondents admitted their in-game spending had impacted their ability to afford basic necessities like rent and food. This issue was more pronounced among men (22.8%) compared to women (14.8%). Paradoxically, while individual spending amounts decreased from 5,138 yen to 4,247 yen monthly, participation in microtransaction-based gaming increased by 5.8%.

Japan’s contribution to global mobile monetization remains substantial, accounting for 14.3% of the $6.79 billion spent via Apple App Store and Google Play in March 2025. This demonstrates the country’s continued importance in the global gaming economy despite concerning individual spending patterns.

Game Category Performance and Monetization

The distribution of in-game revenue across different game tiers reveals the concentration of monetization success among AAA and free-to-play titles. These games collectively generate approximately 95% of all in-game revenue, with microtransactions serving as the primary monetization vehicle.

Free-to-play games demonstrate particularly effective monetization, with 80% of their revenue derived from in-app purchases. This model has proven especially successful in mobile gaming, where accessibility and ongoing engagement drive sustained revenue generation. The success of this model has influenced broader industry trends, with many traditional developers adopting elements of free-to-play monetization.

The effectiveness of different monetization approaches is closely tied to global esports revenue projections, as competitive gaming drives both participation and spending in free-to-play titles.

Industry Challenges and Adaptations

The gaming industry faces several significant challenges as it navigates evolving consumer behaviors and economic pressures. The decline in Generation Z spending represents more than a temporary downturn; it signals a fundamental shift in how younger consumers approach entertainment spending priorities.

Developers and publishers are responding to these challenges through various adaptive strategies. The emergence of hybrid monetization models, combining traditional purchases with subscription services and microtransactions, reflects industry efforts to maintain revenue growth while accommodating diverse consumer preferences and financial constraints.

The rise of streaming platforms and content creation has also influenced spending patterns, as players increasingly discover games through content creators and may prioritize different aspects of the gaming experience than previous generations.

Technology Integration and Future Trends

Emerging technologies continue to reshape gaming monetization strategies. Artificial intelligence and machine learning applications are increasingly being utilized to personalize in-game offers and optimize monetization timing, leading to more targeted and potentially effective revenue generation approaches.

The integration of advanced analytics and player behavior prediction has enabled developers to create more sophisticated monetization strategies that balance player satisfaction with revenue generation. This data-driven approach is particularly evident in mobile gaming, where immediate feedback loops allow for rapid iteration and optimization.

Cloud gaming services and cross-platform play are also influencing monetization strategies, as they enable more seamless player experiences across different devices and potentially increase engagement with in-game purchase opportunities. The relationship between gaming hardware preferences and spending patterns continues to evolve as these technologies mature.

Market Outlook and Projections

Looking ahead, the gaming industry appears positioned for continued growth despite current demographic challenges. The overall market trajectory toward $200 billion in 2025 remains intact, supported by strong performance in established markets and emerging opportunities in developing regions.

Mobile gaming is expected to maintain its dominant position, with continued growth in emerging markets offsetting slower growth in mature regions. The development of new monetization models and the integration of social commerce features are likely to drive further evolution in how players interact with and spend money on games.

The industry’s ability to adapt to changing consumer preferences, particularly among younger demographics, will be crucial for sustained growth. This includes developing pricing strategies that accommodate varying economic circumstances while maintaining the quality and engagement that drive long-term player retention.

Frequently Asked Questions

What is driving the growth in global gaming revenue?

The growth in global gaming revenue is primarily driven by the expansion of mobile gaming, increased adoption of in-app purchases, and the success of free-to-play monetization models. Mobile gaming alone accounts for 49% of total revenue, while in-app purchases have become the dominant revenue stream across all platforms.

Why is Generation Z spending less on gaming?

Generation Z’s reduced gaming spending is attributed to economic pressures including challenging job markets, student loan obligations, rising living costs, and high credit card delinquency rates. Despite spending less, this demographic remains active in gaming by choosing free-to-play games and waiting for sales on premium titles.

How do regional markets differ in gaming monetization?

Regional markets show significant variation in growth patterns. Western markets like North America and Europe are experiencing strong growth in in-app purchases (+9% and +14% respectively), while Asian markets have seen slower growth or decline (-3% in USD terms). Emerging markets in the Middle East and Latin America show the highest growth rates.

What role do mobile games play in the current market?

Mobile games dominate the gaming market with $92 billion in revenue (49% of total market). Mobile in-app purchases reached $81 billion in 2024, showing resilience with 4% growth after previous declines. The platform’s accessibility and effective monetization strategies make it the primary driver of industry growth.

How are in-game purchases affecting financial well-being?

Studies from Japan reveal concerning trends, with 18.8% of young adults (20-29) reporting that in-game spending affected their ability to pay for essentials like rent and food. This highlights the need for financial literacy education and potentially stronger consumer protection measures in gaming monetization.

What trends are shaping the future of gaming monetization?

Key trends include the rise of hybrid monetization models combining purchases, subscriptions, and ads; increased use of AI for personalized offers; growth in subscription-based gaming services; and the development of social commerce features within games. Cross-platform play and cloud gaming are also influencing monetization strategies.

Sources and Citations

- Sensor Tower. (2025). “State of Mobile 2025 Report: Global in-app purchase revenue reaches $150 billion.” https://sensortower.com/blog/2025-state-of-mobile-consumers-usd150-billion-spent-on-mobile-highlights

- Newzoo. (2025). “Global Games Market Report: Gaming industry revenue and platform breakdown.” https://www.blog.udonis.co/mobile-marketing/mobile-games/gaming-industry

- Circana. (2025). “Gen Z Video Game Spending Analysis and Industry Trends.” https://www.pcgamer.com/gaming-industry/new-study-shows-that-gen-z-is-spending-way-less-money-on-videogames-than-older-gamers/

- SMBC Consumer Finance. (2025). “Annual Survey on Spending Habits of Japanese Young Adults.” https://automaton-media.com/en/news/almost-19-of-japanese-people-in-their-20s-have-spent-so-much-money-on-gacha-they-struggled-with-covering-living-expenses-survey-reveals/

- Boston Consulting Group. (2024). “Leveling Up: The 2024 Gaming Report – Industry Revenue and Growth Analysis.” https://www.bcg.com/press/12december2024-future-of-global-gaming-industry