Multiplayer vs Single-Player Gaming Preference Statistics [2025]

The gaming space in 2025 continues to showcase a fascinating divide between players who favor immersive solo experiences and those who thrive in competitive or cooperative multiplayer environments. Recent comprehensive surveys reveal that gaming preferences vary significantly across age demographics, platforms, and gender lines, with substantial implications for the industry’s future direction.

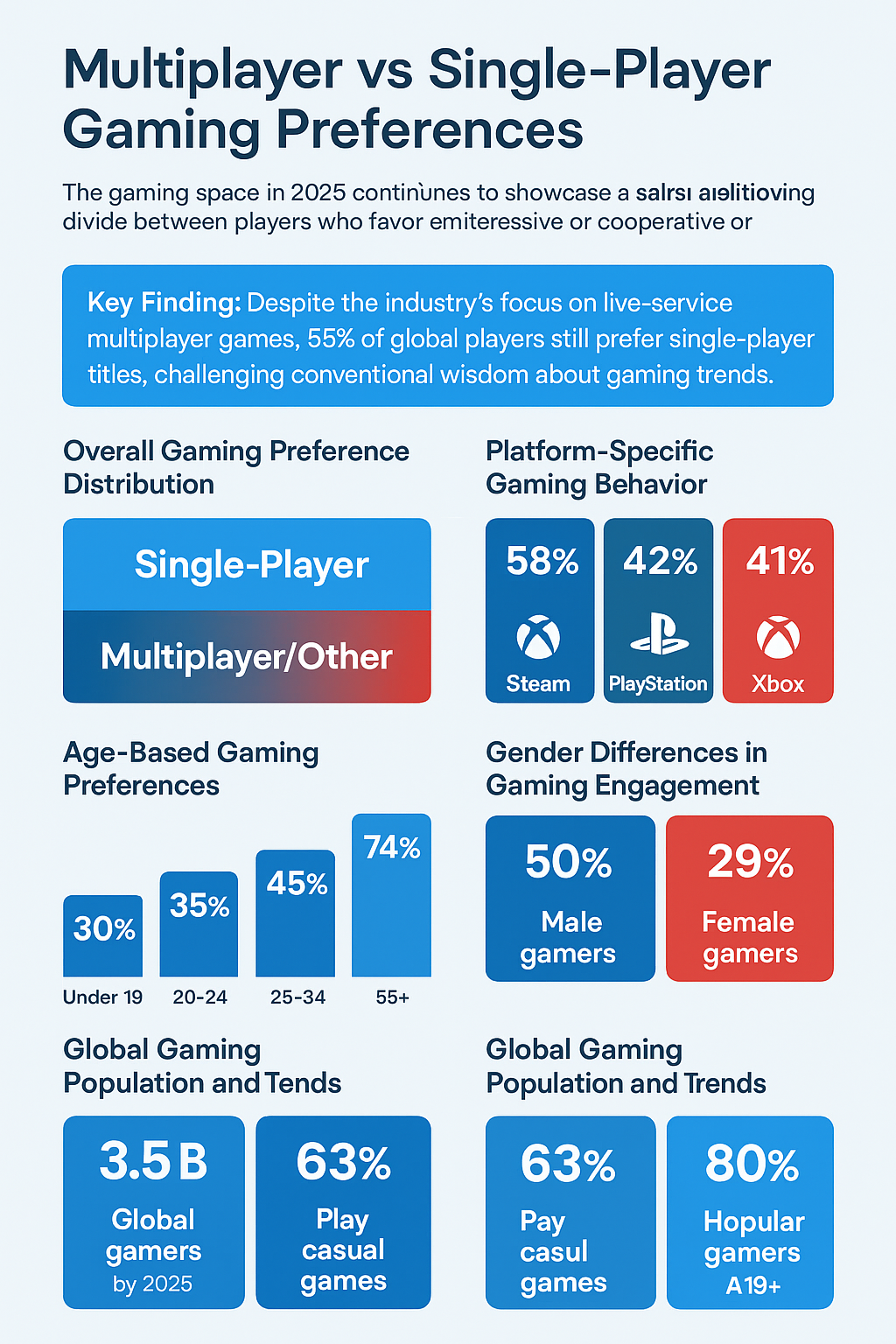

Overall Gaming Preference Distribution

Single-Player vs Multiplayer Preferences (Global)

This data represents a comprehensive analysis from MIDiA Research, surveying gamers across multiple regions including the United States, United Kingdom, Australia, Canada, France, Germany, Poland, Brazil, South Africa, and Turkey. The findings demonstrate that single-player gaming maintains its dominance despite the industry’s increasing emphasis on esports revenue projections and multiplayer-focused development.

Platform-Specific Gaming Behavior

Platform preferences reveal distinct gaming behaviors, with PC gamers on Steam demonstrating a stronger inclination toward single-player experiences compared to console users. This trend aligns with PC gaming’s historically rich catalog of narrative-driven and simulation games. Console platforms, while still favoring single-player content, show higher engagement with multiplayer modes, particularly in competitive gaming scenarios.

| Platform Metric | Value | Growth Trend |

|---|---|---|

| Global Average Gaming Time (2025) | 8.6 hours per week | ↑ from 8.2 hours (2024) |

| Cross-platform Retention Boost | 31% higher return rate | Consistent growth |

| U.S. Gaming Service Subscriptions | 52% of all gamers | Growing adoption |

The rise in cross-platform gaming has significantly impacted player retention, with those using multiple platforms returning to games 31% more often than single-platform users. This trend reflects the gaming industry’s evolution toward more integrated experiences, similar to patterns observed in Minecraft server multiplayer analytics.

Age-Based Gaming Preferences

Single-Player Preference by Age Group

Under 19

Strong multiplayer preference

20-24

Transitional preferences

25-34

Increasing solo play

55+

Overwhelming single-player preference

Age demographics reveal the most pronounced differences in gaming preferences. Younger players, particularly those under 19, demonstrate strong preferences for multiplayer experiences, with only 30% favoring single-player games. This preference dramatically shifts with age, reaching 74% for gamers aged 55 and above. The transition typically occurs around age 25, when life commitments make coordinating multiplayer sessions more challenging.

| Age Group | Online PvP | Local Co-op | PvE (Group) |

|---|---|---|---|

| Under 19 | 40% | 28% | – |

| 20-24 | 43% | 22% | – |

| 25-34 | – | 24% | 21% |

| 55+ | – | – | 6% |

The 20-24 age group shows the highest engagement with online PvP gaming at 43%, while local co-op gaming peaks among the 16-19 demographic at 28%. These patterns reflect both technological adoption and social gaming habits that evolve with life circumstances.

Gender Differences in Gaming Engagement

Live-Service vs Solo Gaming by Gender

Gender differences in gaming preferences reveal significant disparities in live-service game engagement. According to Deloitte’s comprehensive Digital Media Trends report, only 29% of female gamers regularly engage with live-service multiplayer games, compared to approximately 50% of male gamers. This gap highlights important considerations for game developers and publishers targeting diverse audiences.

The preference for solo, story-driven games spans across gender lines, with 50% of all surveyed gamers expressing this preference. This finding supports the continued viability of narrative-focused game development and suggests opportunities for more inclusive gaming experiences that don’t rely heavily on competitive multiplayer mechanics.

Global Gaming Population and Trends

The global gaming population continues its remarkable expansion, with projections indicating 3.5 billion gamers worldwide by 2025, up from 3.32 billion in 2024. This growth reflects gaming’s evolution from a niche hobby to a mainstream entertainment medium. The demographic composition reveals that 80% of gamers are adults, representing approximately 2.47 billion adult players globally.

Casual gaming maintains strong popularity, with 63% of global gamers engaging with casual titles. This trend supports the single-player preference data, as casual games typically feature solo gameplay mechanics that align with broader gaming preferences. The popularity of casual gaming also creates opportunities for developers to create engaging experiences that don’t require significant gaming hardware upgrade frequency.

Industry Implications and Development Trends

The persistent preference for single-player gaming presents both challenges and opportunities for the gaming industry. While live-service games generate substantial ongoing revenue through microtransactions and subscriptions, the data suggests that focusing exclusively on multiplayer experiences may overlook a significant portion of the gaming audience.

The success of recent single-player titles across various platforms demonstrates the continued commercial viability of solo gaming experiences. Games that combine strong narrative elements with engaging mechanics continue to attract large audiences and achieve critical acclaim. This trend parallels successful gaming content creation, as evidenced by popular Minecraft content creation streaming analytics.

Publishers are increasingly recognizing the value of balanced portfolios that include both single-player and multiplayer offerings. This approach allows companies to serve diverse audience preferences while maintaining revenue streams from both traditional game sales and ongoing live-service operations.

Platform Evolution and Cross-Platform Gaming

Cross-platform compatibility has emerged as a significant factor in player retention and engagement. Players who access games across multiple platforms demonstrate 31% higher return rates, indicating that accessibility and continuity enhance the gaming experience regardless of whether players prefer single-player or multiplayer modes.

The subscription model adoption rate of 52% among U.S. gamers reflects the industry’s successful transition toward service-based offerings. However, these subscriptions often include extensive single-player game libraries, further supporting the demand for solo gaming experiences. Console gamers show particularly high subscription adoption at 74%, while PC gamers follow at 66%.

Cloud gaming and streaming services have democratized access to high-quality single-player experiences, reducing barriers related to hardware requirements and enabling more players to enjoy premium gaming content. This accessibility expansion aligns with the growing adult gaming demographic and their preference for convenient, flexible gaming options.

Regional and Cultural Gaming Preferences

Geographic variations in gaming preferences add another layer of complexity to the single-player versus multiplayer discussion. While the global trend favors single-player gaming, regional preferences can vary significantly based on cultural factors, internet infrastructure, and local gaming ecosystems.

The growth of gaming content creation and streaming has influenced player preferences across regions. Content creators often showcase both single-player narrative experiences and competitive multiplayer gameplay, exposing audiences to diverse gaming styles. This exposure has contributed to more varied gaming preferences and has helped sustain interest in both gaming modes.

Understanding these regional preferences becomes crucial for developers targeting global audiences. Games that offer flexible gameplay options, allowing players to choose between solo and multiplayer experiences, often achieve broader appeal across different markets and demographic segments.

Future Outlook and Gaming Evolution

The gaming industry’s future likely involves continued balance between single-player and multiplayer offerings rather than a complete shift toward either model. Successful franchises increasingly incorporate both gameplay styles, providing campaign modes for solo players while offering competitive or cooperative multiplayer options for social gaming.

Technology advances in artificial intelligence and procedural generation may enhance single-player experiences by creating more dynamic and personalized content. These innovations could further strengthen the appeal of solo gaming while reducing development costs associated with creating extensive single-player content.

The rise of hybrid gaming experiences that blend single-player progression with optional multiplayer elements represents a potential growth area. These games allow players to enjoy solo experiences while providing opportunities for social interaction when desired, effectively serving both preference groups within a single product.

Market analysis suggests that successful gaming companies will continue diversifying their portfolios to serve both single-player and multiplayer audiences. This approach maximizes market reach while reducing dependence on any single gaming model or revenue stream. Understanding player preferences across demographics becomes increasingly important as the gaming audience continues expanding and diversifying.

Frequently Asked Questions

Why do most gamers prefer single-player games over multiplayer?

Several factors contribute to the 53% preference for single-player gaming. Many players value the ability to play at their own pace without coordinating with others, especially as life becomes busier with age. Single-player games offer uninterrupted storytelling experiences and eliminate concerns about online toxicity, competitive pressure, or technical issues like lag and server problems.

How does age affect gaming preferences between single-player and multiplayer?

Age significantly impacts gaming preferences, with younger players (under 19) showing only 30% preference for single-player games, while gamers aged 55 and above prefer single-player experiences at 74%. The shift typically occurs around age 25 when life commitments make coordinating multiplayer sessions more challenging, leading to increased appreciation for flexible single-player gaming.

What are the gender differences in gaming preferences?

Gender differences are notable in live-service game engagement, with only 29% of female gamers regularly playing live-service multiplayer games compared to approximately 50% of male gamers. However, 50% of all gamers, regardless of gender, prefer solo story-driven games, indicating that narrative-focused single-player experiences have broad appeal across demographic lines.

Do PC gamers have different preferences than console gamers?

Yes, platform choice significantly affects gaming preferences. Steam PC users spend 58% of their gaming time on non-competitive, single-player content, while PlayStation users spend 42% and Xbox users spend 41% on similar content. This suggests PC gamers have a stronger inclination toward solo gaming experiences compared to console users.

How has the gaming industry responded to single-player preferences?

While many publishers initially focused heavily on live-service games, recent market data showing strong single-player preferences has led to more balanced approaches. Companies are now developing portfolios that include both single-player narratives and multiplayer experiences, recognizing that serving diverse player preferences maximizes market reach and reduces business risk.

What role does mobile gaming play in these preferences?

Mobile gaming reinforces single-player preferences, with 58% of mobile gamers preferring single-player titles. This challenges assumptions about mobile gaming’s social nature and demonstrates that even on platforms designed for connectivity, many players prefer solo experiences that they can enjoy during commutes, breaks, or other convenient moments.

Sources

- MIDiA Research. (2024). Most gamers prefer single-player games

- Deloitte Insights. (2024). Digital Media Trends: Women in Gaming

- Statista. (2025). U.S. single player vs. multiplayer video gaming preference

- Newzoo. (2025). Gaming Industry Report 2025: Market Size & Trends

- DemandSage. (2025). How Many Gamers Are There? Gaming Statistics