Retro Gaming Console Sales Statistics (2025)

Retro Gaming Console Sales Statistics 2025: Market Analysis and Growth Trends

The retro gaming console market has experienced a remarkable resurgence in 2024 and early 2025, transforming from a niche collector hobby into a multi-billion-dollar industry segment. This comprehensive analysis examines the latest retro gaming console sales statistics, market trends, and growth projections that define the vintage gaming landscape.

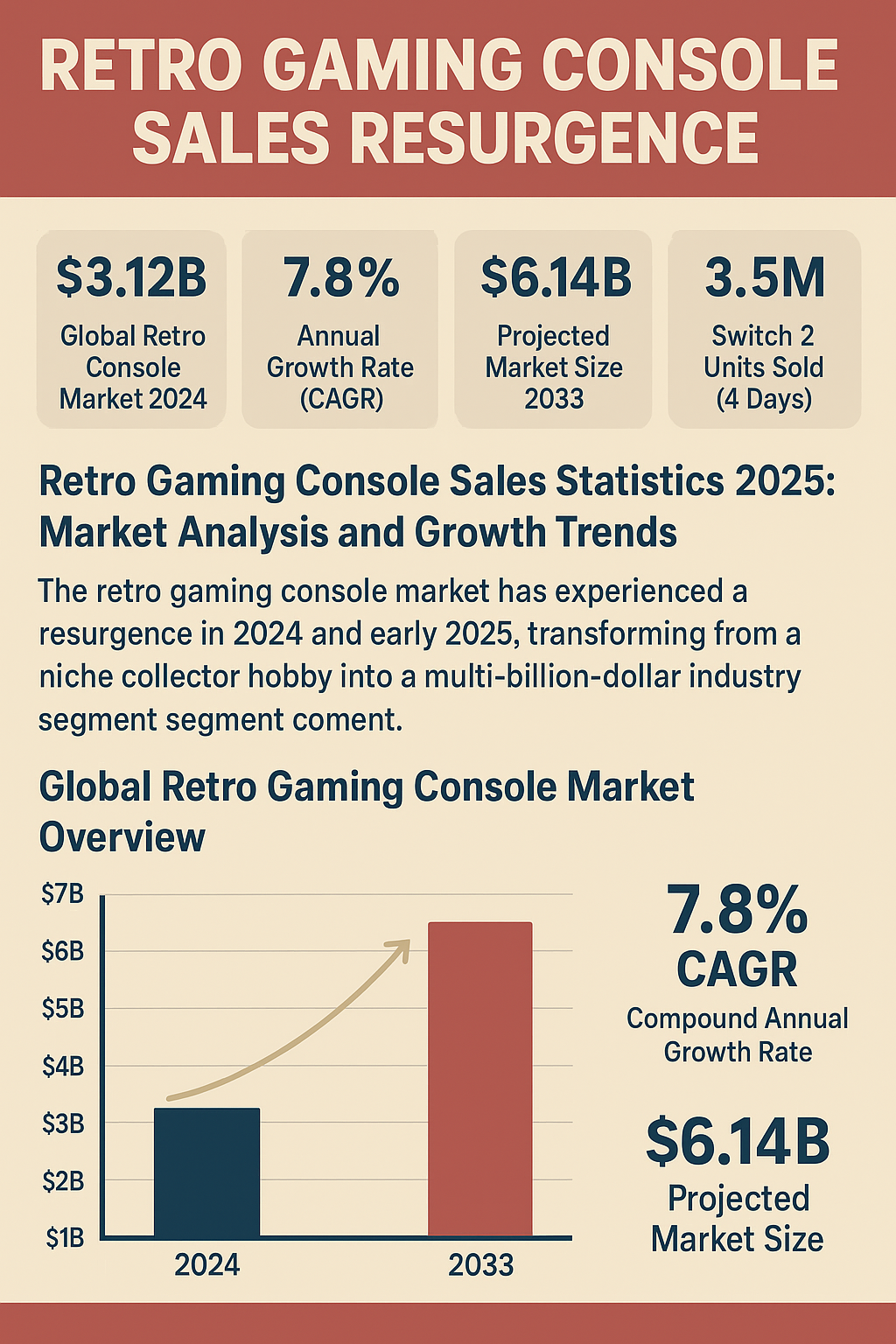

Global Retro Gaming Console Market Overview

The global retro gaming console market reached USD 3.12 billion in 2024, representing significant growth in the vintage gaming sector. Market analysts project this sector will expand at a compound annual growth rate (CAGR) of 7.8% from 2025 to 2033, potentially reaching USD 6.14 billion by 2033. This growth substantially outpaces the broader gaming hardware upgrade frequency trends in the mainstream console market.

Retro Console Market Size vs Traditional Gaming Market

While the total video game console market reached USD 55.8 billion in 2024, retro consoles account for approximately 5.6% of this market. However, the retro segment’s 7.8% growth rate significantly exceeds the mainstream console market’s expansion rate of 1.85%, indicating stronger consumer interest in nostalgic gaming experiences compared to gaming laptop vs desktop preferences.

| Market Segment | 2024 Value (USD Billion) | CAGR (2025-2033) | 2033 Projection (USD Billion) |

|---|---|---|---|

| Retro Gaming Consoles | 3.12 | 7.8% | 6.14 |

| Total Gaming Consoles | 55.8 | 1.85% | 62.4 |

| Plug-and-Play Consoles | 4.38 | 3.5% | 6.10 |

Segment-Specific Revenue Analysis

Plug-and-Play Retro Console Performance

The plug-and-play retro console segment generated USD 4.38 billion in 2024, with projections to reach USD 6.10 billion by 2033 at a 3.5% CAGR. This segment represents mature market demand for accessible retro gaming solutions that require minimal setup for consumers seeking nostalgic experiences.

Key Market Insight

Retro consoles are doubling in market size over the next decade, revealing sustained consumer interest driven by nostalgia and technological improvements in miniaturized classic systems.

Consumer Interest and Search Trends

Google Trends data reveals significant consumer engagement with retro gaming topics throughout 2024 and 2025. “Retro handheld game consoles” peaked at 69 on the normalized index in January 2025, while “retro gaming systems” reached 17 in July 2025. These search patterns coincide with increased TikTok gaming video engagement rates for retro content.

YouTube Content Creation Growth

YouTube uploads focused on retro gaming increased 1,000-fold from 2007 to 2023, with “retro gaming console” searches hitting 89 on Google Trends in December 2024. This surge in content creation mirrors broader trends in Twitch statistics for retro gaming streams.

Modern Console Release Impact: Nintendo Switch 2 Performance

The Nintendo Switch 2 launch in June 2025 provides context for understanding retro console market dynamics. The Switch 2 sold 3.5 million units globally within four days of release, making it Nintendo’s fastest-selling console ever. In the United States alone, the Switch 2 sold over 2 million units in its second month, exceeding the original Switch pace by 75%.

Hardware Spending Records

July 2025 hardware spending reached USD 384 million in the US, the highest since 2008, driven largely by Switch 2 sales. This demonstrates that while mainstream consoles dominate headlines, the retro market thrives independently, serving different consumer needs related to multiplayer vs single-player gaming preferences.

Retro Handheld Console Market Growth

Community-sourced data estimates global retro handheld sales from 2020-2024 reached approximately 3.825 million units across major brands. Leading manufacturers include Anbernic with 1.25 million total units, Powkiddy with 900,000 units, and Retroid Pocket with 730,000 units over the five-year period.

| Brand | 2024 Annual Sales | Total 2020-2024 | Market Share |

|---|---|---|---|

| Anbernic | 350,000 | 1,250,000 | 32.7% |

| Powkiddy | 250,000 | 900,000 | 23.5% |

| Retroid Pocket | 200,000 | 730,000 | 19.1% |

| AYN Odin | 130,000 | 450,000 | 11.8% |

| Analogue Pocket | 150,000 | 495,000 | 12.9% |

Regional Market Distribution

North America accounts for approximately 38% of global retro console revenue, valued at USD 1.19 billion in 2024. Europe represents 29% with USD 0.90 billion, while the Asia-Pacific region contributes 23% at USD 0.72 billion. These regional patterns reflect different gaming cultures and economic factors influencing in-game purchase spending habits.

Market Growth Drivers and Future Outlook

Several factors contribute to the robust growth in retro gaming console sales statistics. Nostalgia among adults with increased disposable income drives primary demand, while technological improvements enable better emulation and user experiences. The collector market for limited edition releases and the integration of modern features like HDMI output and wireless controllers enhance appeal for contemporary users.

Growth Projection Summary

The retro console market is positioned to double by 2033, driven by sustained nostalgia demand, technological integration, and expanding collector communities across global markets.

Competitive Landscape Analysis

The retro console market operates parallel to mainstream gaming without direct competition. While modern consoles focus on cutting-edge graphics and online services, retro systems serve preservation and nostalgia needs. This market positioning supports sustainable growth independent of global esports revenue projections trends.

Frequently Asked Questions

The global retro gaming console market reached USD 3.12 billion in 2024 and is projected to grow at a 7.8% CAGR to reach USD 6.14 billion by 2033. This represents significant growth in the vintage gaming sector.

Retro consoles account for approximately 5.6% of the total gaming console market, but their 7.8% growth rate significantly exceeds the mainstream console market’s 1.85% expansion rate, indicating stronger consumer interest in nostalgic gaming experiences.

Anbernic leads with 1.25 million units sold from 2020-2024, followed by Powkiddy (900,000 units), Retroid Pocket (730,000 units), Analogue Pocket (495,000 units), and AYN Odin (450,000 units). Total retro handheld sales reached 3.825 million units over this period.

Key growth drivers include nostalgia among adults with disposable income, technological improvements in emulation and hardware, the expanding collector market, integration of modern features like HDMI output, and the preservation of gaming history.

The Nintendo Switch 2 sold 3.5 million units in its first four days, becoming Nintendo’s fastest-selling console. While this dominates mainstream headlines, the retro market operates independently, serving different consumer needs for nostalgic gaming experiences.

North America leads with 38% of global revenue (USD 1.19 billion), Europe accounts for 29% (USD 0.90 billion), and Asia-Pacific represents 23% (USD 0.72 billion) of the retro gaming console market in 2024.

Sources and References

- Growth Market Reports – Retro Gaming Console Market Research Report 2025

- Future Data Stats – Retro Console Market Size & Industry Growth 2030

- Nintendo Official – Switch 2 Sales Announcement June 2025

- Market.us – Gaming Console Statistics and Facts 2025

- Mordor Intelligence – Gaming Console Market Forecast 2025-2030